Four years ago, then vice presidential candidate Joe Biden was pilloried by Republican politicians and their media water carriers (for example, here and here) for telling wealthier Americans "it's time to be patriotic" by paying the slightly higher tax rates of the Clinton boom years. But with the renewed debate over ending the Bush tax cuts for the rich, the recent departures of former U.S. citizens Eduardo Saverin and Denise Rich and, most of all, Mitt Romney's AWOL tax returns and mysterious foreign shelters, the issue of taxes and patriotism is back on the front-burner. And now, the GOP's best and brightest tell us, stiffing Uncle Sam is as American as apple pie.

That was the conclusion of South Carolina Republican Sen. Lindsey Graham. Last week, Graham explained that Mitt Romney's labyrinthine finances and tax bill shrunken by the notorious carried interest exemption, a $100 million IRA and accounts in Bermuda, Switzerland and the Cayman Islands should not only be expected, but lauded. "It's really American to avoid paying taxes, legally," Graham announced, adding:

"It's a game we play. Every American tries to find the way to get the most deductions they can. I see nothing wrong with playing the game because we set it up to be a game."A game, that is, which will be won by the well-to-do, apparently the only ones qualified to play it. In rejecting a small increase in gilded class tax rates, President George W. Bush summed up the rules by explaining that "the really rich people figure out how to dodge taxes anyway." Supply-side snake oil salesman Arthur Laffer agreed:

"You really can't collect much money from upper-income people. They know how to get around taxes."For some in the Republican amen corner, Uncle Sam shouldn't even try. Defending Mitt Romney's puny 14 percent payment to the U.S. Treasury (a rate lower than many middle class families), James Pethokoukis of the American Enterprise Institute protested that "actually, Mitt Romney's tax rate is too high":

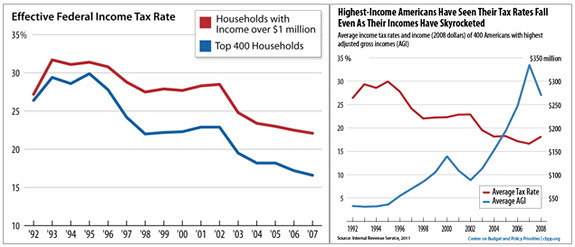

It's real simple: If you think the biggest problem facing the United States today is income inequality, then you should be outraged that Mitt Romney's income tax rate isn't higher. But if you instead think America's biggest problem is high unemployment and a lack of economic growth, then you should be outraged that Romney is paying any income taxes at all. Really.Of course, to believe that, you have to pretend that today's historically low 15 percent capital gains tax rate and the staggering income inequality it produces also fuels investment in the U.S. economy. And as the data show, that simply is not true. (For more on the "job creators," capital gains and other right-wing myths, see "10 Things the GOP Doesn't Want You to Know about Taxes.")

For others on the right, Mitt Romney's contortionist act on taxes pales in comparison to the real heroes like fleeing Facebook co-founder Eduardo Saverin. As John Tamny explained in his Forbes paean to that American turncoat:

Indeed, Saverin's U.S. "de-friend" is great for economic growth on its face, and then the political implications of his move will hopefully pay future taxation dividends that accrue to entrepreneurialism and advancement... Assuming nosebleed rates of taxation were a driver of Saverin's decision, politicians will hopefully see that if too greedy about collecting the money of others, they'll eventually collect nothing.If those whose creative accounting has dramatically slashed their tax bills are the heroes, then the people Americans have entrusted to collect those funds must be the villains. And for the Republicans, that of course is the IRS.

Back in the 1990s, Congressional Republicans successfully used that kind of demagoguery to undermine both the Internal Revenue Service itself and the tax revenue it is supposed to collect. They haven't stopped since.

(Continue reading below the fold.)

No comments:

Post a Comment